When it comes to vendor management, the finance function is the missing link that can drive accountability and operations.

By overseeing vendor relationships, the finance functions can ensure compliance with contractual terms and manage risks effectively.

Let’s say a company’s payroll provider suffers a data breach. The company could face substantial financial and reputational damage. This highlights the importance of having effective vendor management strategies in place.

While third-party vendors contribute to operational efficiency and cost reduction, working with vendors also widens the scope of potential cybersecurity vulnerabilities, demanding robust vendor risk management strategies.

Third-party data breaches are more costly than you think. We’ve got a few numbers to back this up:

- 82% of organizations have experienced one or more data breaches caused by third parties in the past two years.

- The average cost of a third-party data breach is approximately USD 4.33 million, compared to USD 3.86 million for internal breaches.

Finance teams need a proactive approach to vendor risk management. And beyond risk management, they must also ensure secure data storage, compliance with regulations, and timely payments to vendors.

This article will examine the vendor challenges finance teams face and provide effective solutions to address these issues.

[cta_block]

Table of Contents

- The finance team’s responsibilities in managing vendor relationships

- Key vendor challenges finance teams face

- How finance teams can overcome vendor management challenges

- Enhancing efficiency in vendor relations with automated workflows

The finance team’s responsibilities in managing vendor relationships

Finance teams play a crucial role in vendor management, from contract negotiation to payment processing and relationship building. Effective vendor management by finance teams significantly contributes to an organisation’s success. Here’s how:

- Negotiating contracts: Finance teams use financial reports to review and negotiate vendor contracts, leveraging spending patterns and vendor performance for better terms. For example, after analysing annual office supplies spending, a company might secure a bulk discount with a preferred vendor which helps reduce overall costs.

- Setting budgets and spending limits: The finance function sets clear budgets and spending limits for vendor management, ensuring financial discipline.

- Providing financial reports: The finance team delivers critical insights into spend management and company health.

- Ensuring regulatory compliance: Finance conducts due diligence to verify vendor compliance with industry regulations, such as data protection laws.

- Managing communication and payments: Finance tracks emails related to invoices and payments, reducing the risk of late payments that could adversely impact vendor relationships and service consistency.

Key vendor challenges finance teams face

Imagine being interrupted on your day off because a vendor payment wasn’t processed on time. This is just one of many challenges finance teams face in vendor management.

Here are a few other commonly faced vendor challenges:

1. Vendor reliability

Unreliable vendors can disrupt supply chains and cause production delays. Ensuring vendors meet deadlines consistently is crucial for smooth operations. Without a solid plan for vendor-related disruptions, organisations risk significant downtime. Finance teams must help develop and test these plans to ensure seamless operations during crises.

2. Regulatory and compliance adherence

Thorough vetting of vendors to ensure compliance with industry regulations is essential. Finance teams need to stay updated on evolving regulations and ensure vendors meet these standards to avoid legal penalties. Add to that, ensuring that vendors adhere to contract terms can be challenging. Finance teams must regularly review and enforce compliance with contractual terms to avoid legal and financial repercussions.

3. Cost management

Vendors may attempt to increase prices unexpectedly. Finance teams need to manage and negotiate costs effectively to stay within budget.

4. Data security

Vendors handling sensitive data pose a risk of breaches. Finance teams must ensure robust cybersecurity measures are in place to protect company information. Unmanaged vendor cyber risks can lead to data breaches, harming public opinion and customer trust. Continuous monitoring of vendor security practices is crucial to protecting your organization’s reputation.

5. Communication issues

Poor communication with vendors can lead to misunderstandings and errors. Clear and consistent communication channels are vital for effective vendor management.

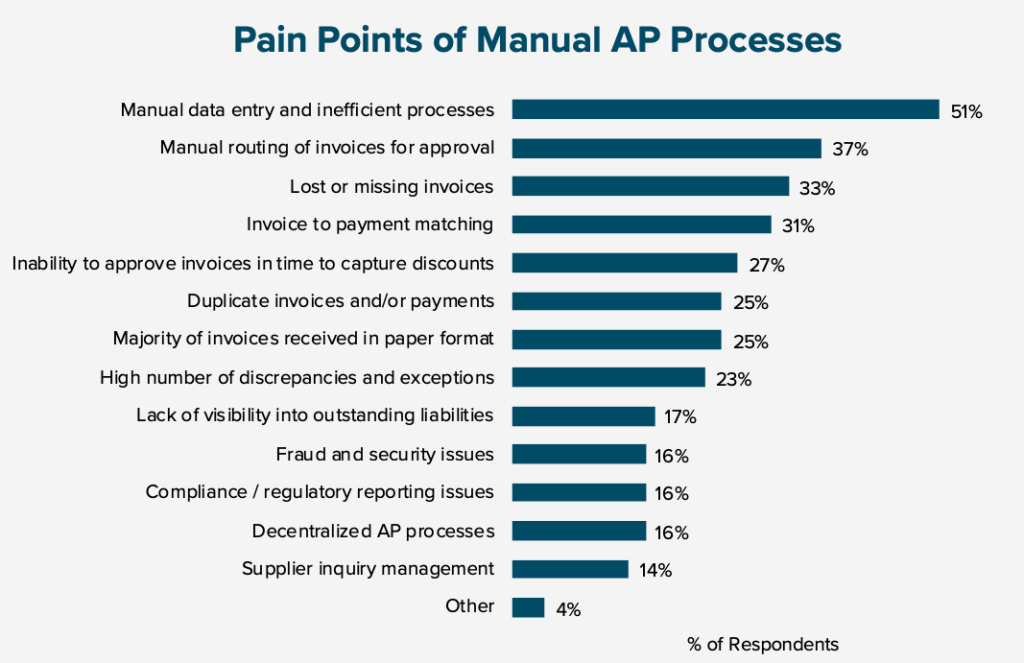

6. Accounts payable management

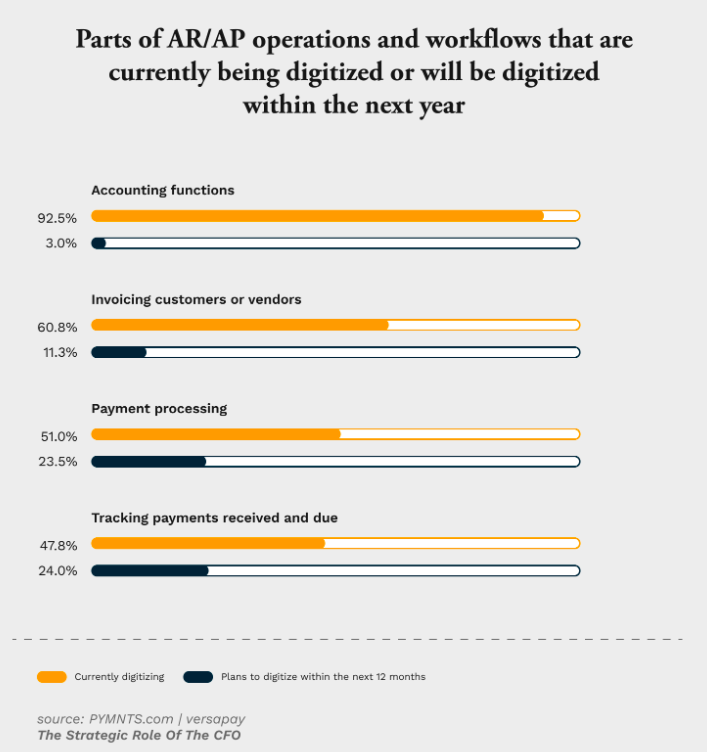

Timely and accurate processing of vendor payments is crucial to maintaining good vendor relationships. Manual accounts payable processes are not only slower, but they are also prone to data inaccuracies and errors. Delays or errors in accounts payable can lead to strained relations, late fees, and even supply chain disruptions. Implementing efficient and automated accounts payable processes helps ensure vendors are paid on time, every time.

How finance teams can overcome vendor management challenges

Finance teams can optimize vendor management through automation by implementing integrated vendor risk management platforms. These platforms streamline the onboarding process, ensuring thorough assessments of potential risks before onboarding vendors. Automated audits help maintain regulatory compliance by conducting routine checks aligned with industry standards.

Additionally, real-time monitoring capabilities enable finance teams to track vendor performance continuously and detect any potential data leaks promptly.

Here are a few proven ways in which the finance teams can reduce compliance risks and effectively safeguard the organization’s financial health and reputation:

1. Automated vendor onboarding

Implement automated vendor risk management platforms that streamline due diligence processes. These platforms use pre-built security questionnaires and automated workflows to assess potential risks before onboarding vendors, ensuring they meet regulatory standards and pose minimal risk to the organization.

2. Enhanced regulatory compliance

Utilize automated vendor risk management solutions to conduct routine assessments and audits. These solutions offer pre-built questionnaire templates aligned with global security frameworks and regulations, simplifying compliance checks and ensuring vendors adhere to industry standards.

3. Proactive data leak detection

Deploy robust data leak detection solutions to continuously monitor the web for potential data leaks involving third parties. These tools provide real-time alerts and insights, allowing finance teams to address vulnerabilities and prevent data breaches that could damage public perception and trust.

4. Continuous vendor performance monitoring

Implement vendor risk management solutions that offer real-time security ratings, continuous monitoring, and risk alerting. These capabilities enable finance teams to maintain visibility over vendors’ security postures, identify emerging risks early, and take proactive measures to protect against financial penalties and operational disruptions.

5. Efficient email management

Leverage email management automation tools like Hiver to streamline vendor communications. These tools facilitate the assignment and tracking of emails related to invoices, payments, and vendor onboarding. By setting up approval workflows and integrating with ERP systems — finance teams can ensure the timely processing of payments, preventing delays that could strain vendor relationships and lead to supply chain disruptions.

Enhancing efficiency in vendor relations with automated workflows

Finance teams can navigate vendor management challenges more effectively through strategic automation. By leveraging tools like Hiver, they streamline workflows for handling vendor queries, accounts payable, and tax issues directly within their email systems. This integration enhances visibility, enabling clear ownership of emails, updates on status, and seamless communication through notes and features like @mentions, where you can tag and notify team members or specific stakeholders. Automation workflows also eliminate the need for manual forwarding, or CCs, ensuring responses are timely and accurate.

Moreover, Hiver’s AI capabilities empower managers to quickly grasp email conversations, accelerating decision-making and the resolution of vendor-related issues. This technological integration not only strengthens vendor management practices but also enhances overall operational efficiency within finance departments. By optimizing communication and workflow processes, finance teams can effectively manage vendor relationships, uphold regulatory compliance, and mitigate risks.